Gain in-depth insights into CRE risk management with the most comprehensive solution for lenders and CMBS investors

REQUEST A DEMOCoStar Risk Analytics is a team of CRE credit risk experts, including Ph. Ds, CFAs, and CPAs, who have extensive experience working with banks of all sizes, regulatory agencies, life insurance companies, and investment firms.

With decades of experience, the industry's most comprehensive commercial real estate database, and the time-tested COMPASS credit default model, CoStar Risk Analytics enables you to examine in-depth markets, buildings, and loans more quickly.

Gain an advantage at every stage of the Lending process with CoStar for Lenders.

Get insightful knowledge and capture opportunities with CoStar CMBS Investor platform.

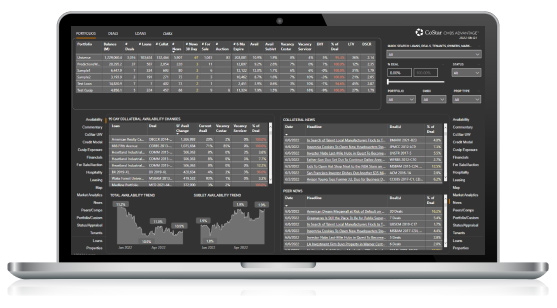

CoStar for Lenders

Your loan portfolio mapped to CoStar’s industry-leading property information, market analytics, and the COMPASS credit default model means you’ll reach sound lending decisions more quickly.

Your loan portfolio

Examined and uploaded to CoStar’s secured database.

Combined with the power of CoStar

6.8M

Commercial

Properties

14.8M

Sale and Lease

Comparables

8.1M

Tenant

Profiles

8.1M

Submarkets

with Forecasts

8.1M

COMPASS Credit

Default Model

Streamline your risk management.

All-in-one data, analytics and credit default modeling.

Why CoStar lenders is right for you.

Gain Operational Efficiency

Provide transparency, meet regulatory guidelines, and put your finest brains to work on analytics.

Win More Deals

Make better and faster loan origination and portfolio decisions by having around-the-clock access to CoStar data and analytics.

Manage Risk With Confidence

Access timely LTV and DSCR for your whole portfolio and maximize its performance with property-level data.

Data Integrity & Security

Advanced technology to clean your data in a fully hosted web solution built to meet all industry-standard security requirements, along with all relevant audit reports.

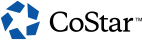

CMBS Advantage

A comprehensive CMBS Investor Platform that integrates INTEX's CMBS data, Costar's industry-leading CRE data, market analytics, and COMPASS Credit Default Model, all mapped directly to each of your CMBS deals, loan, and collateral property.

163.5K

CMBS Properties

1.3M

Peer Properties

1.2M

Sale Comps

2.0M

Lease Comps

500K

Tenants

With the CMBS Investor platform you get:

- Powerful data visualization with configurable dashboards for executive reporting that connects current and forecasted risk assessments.

- Management reports, including stress testing, NOI and property value forecasting, and more.

- Proprietary loan reports with in-depth level credit analysis, a comprehensive of the loan's risk, and accurate cash flow forecasts.

- Expected losses and price yield analysis from our Compass Default model, which is integrated with third-party bond cash flow models.

- Easy setup with minimum IT resources.

Discover how CoStar property data could help your business.

Request a demo today.